I recently, as usual, did not attend the annual Keller Williams international conference in California, where housing and economic trends are discussed at length. I didn’t go for a number of reasons–including I’m just a homebody, I don’t like to fly, and if I’m going to spend money on travel, I’d rather pay to bring our family here from New Zealand for a visit than to travel with a group of other realtors, to be honest. *Photo is of Pugsley and I wearing our souvenir Viking helmets from a past trip to the KW convention in Vegas.

I enjoy digesting the information that comes out of these conferences, which I do by watching the videos of the speeches and following along with the slideshows, from the comfort of my home. This year, what really strikes me is how much national trends need to be interpreted, in order to be relevant to helping buyers and sellers looking to realize their real estate goals in Central Massachusetts.

A current example of nationwide information being correct yet misleading is the latest Case-Shiller index, which just came out on 3/1/2023. This monthly index tracks average single-family home prices in the U.S. over the prior three months. This month it showed a slight decline. The problem with this index is that it’s a national average, and changes to home prices right now vary tremendously by location.

Prices out on the west coast are dropping, while on the other hand, places like Florida are apparently where people want to live, with most estimates being that there are 1,000+ new arrivals every day! This obviously creates great demand for homes, which is why prices are absolutely soaring in Tampa (up 13.9% annually) and Miami (up 15.9%). On the flip side, prices were down 4.2% (annualized) in San Francisco.

What does this have to do with our local market?

All it takes is a look around, and you can see that the population here in Central Massachusetts is growing, in some towns rapidly, which means that home prices are continuing to rise, albeit not like in Miami, thankfully.

There was one slide in particular from Family Reunion (the Keller Williams conference) that was eye opening. This one graphs the price increases by year, nationwide, and illustrates what’s called the “4% rule”. Since at least 1990 home prices, very consistently, grew 4% each year. This reinforces what a good investment a home is, plus you get to live in it.

The biggest concerns I’m hearing about now, for both buyers and sellers, involve interest rates.

Interest rates are up right now because the Federal Reserve is charged with maintaining the stability of our currency, and inflation undermines the value of the dollar. Raising interest rates tends to ‘cool down’ the economy, and this is the only real tool the Fed has to control inflation. The situation is currently complicated by the fact that the measures of inflation are somewhat contradictory, with one showing inflation accelerating, the other that it is moderating. I’m not going to dive any deeper into this, since I’m swimming in the shallow end when it comes to economics, but rather to put today’s interest rates into perspective, and discuss what they mean to home buyers and sellers.

Check out this price! $6.19 for about 20 crackers. It’s back to Triscuits for us.

How to handle Interest Rates

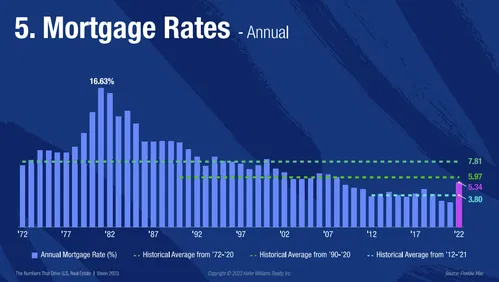

During the pandemic, interest rates dipped as low as 2.5%. Anyone who financed or refinanced at this rate, or anything close to it, took advantage of a once in a lifetime opportunity. Now interest rates are hovering above 6%, which considerably raises the monthly payment on a mortgage, and has some buyers holding back on buying a home.

Waiting for interest rates to come back down isn’t a good strategy at this point, mainly because the 2.75% mortgage rate boat has already sailed (you missed that boat), and our current rates are about average for mortgages over the last 30+ years, so this doesn’t mean you should hold off home buying or selling (selling is trickier).

As a potential buyer, you are already living somewhere, and if you’re paying rent (or even if you are living somewhere for free), you’re almost always better off buying a home. Back in 1984 people were still buying houses, and the rates were 18%, and you know what? Those buyers still almost always made money for three reasons:

1. They weren’t paying rent.

2. They refinanced when rates came down.

3. Their homes appreciated substantially in value.

For sellers it’s slightly trickier. The only downside really is that there may not be as many qualified buyers due to higher monthly payments, but as we saw during the pandemic market, there are very many buyers out there. You don’t need 70 sets of buyers at your open house to get a good price.

It’s tough to give up a really low mortgage interest rate if you have one, but assuming there is a valid and important reason to move, you just need to figure out if it’s worth it. It probably is. If you want to move to a bigger house, want to move to Florida, want to move into a better school district, or have had your job transferred, it’s a lot more than a strictly financial decision.

People buy and sell based on what’s going on in their life. Most importantly, your house has probably appreciated in value, and if you’ve been in the house long enough, you might even be a cash buyer at your next home, in which case who cares what the interest rates are? And, that new house is almost always a good investment.

The Housing Market this Month in Central Massachusetts

The real estate market in Central Massachusetts is still strong, and it’s actually a good time to buy or sell.

For buyers, although you missed the boat on historically low interest rates, you also missed the incredibly crazy pandemic real estate market of open houses with 70 sets of people, 20 high offers, and bidding wars. And, if rates do drop to lower levels, refinance. Real estate has always been a good investment (for most people, it’s their best investment), and homes here in Central Massachusetts are appreciating in value.

For sellers, it’s also a good, steady market. The crazy appreciation of homes during the pandemic market has stuck–home prices aren’t going down, and we benefit from the same phenomena that has people moving to Florida. It’s a great place to live. The big reason again is location, location, location….people are moving out our direction because they can get the same or a better house out here for a lot less money than they’d spend on a house nearer to Boston; and there are so many other amenities here, such as hiking trails, low crime rates, good schools, bigger yards, local ski areas, tennis courts, proximity to Worcester (which is enjoying a renaissance of sorts), and a commuter rail to Boston.

These factors are more or less fixed (you have to move here to get them), and have a major impact on our particular real estate market. People want to live here, in the small cities and towns of Central Massachusetts, which is why, in my opinion, our local real estate market will remain vibrant.

Thinking of buying or selling real estate in Central Massachusetts? Please reach out to me for a confidential conversation about your situation.

Jennifer Shenk

Keller Williams Realty North Central

107 Main Street, Westminster

Call/Text: 978 870 9260

Email: jennifershenk@kw.com