The state of the real estate market here in Central Massachusetts is essentially unchanged, despite the unsettled nature of the real estate profession resulting from the court cases concerning buyer agent commissions. Right now, of course, that court case has nothing to do with the real estate market, because the proposed settlement is still just proposed at this point, and the outcome hasn’t gone into effect yet. If you read last month’s summary of the market here in central Massachusetts, feel free to skip the next paragraph and jump ahead to my thoughts on this proposed settlement.

There has been and remains a major shortage of homes for sale in central Massachusetts, due to the same factors that have driven the market for at least a year now. Many current homeowners have mortgages far below current rates (like 2.75%), so are reluctant to sell; land suitable for home building is scarce (zoning and the New England land/rock scape); and people are moving into our area, for quality of life issues and home prices far less than closer to Boston. Here in central Massachusetts we have good schools, lots of protected land, bigger yards, a low crime rate, and a lot of opportunity for outdoor activities. We’re also close to Worcester, a mid-sized city with excellent universities, museums, restaurants, and stores. Central Massachusetts is up and coming.

However, on the macro level there is a new factor that might (and is beginning to) affect interest rates. Employment was higher/stronger than expected this past month, which sounds good, but also is an issue–the government has been pumping a lot of money into the economy, and this increases hiring, but also has the potential to overheat the economy, resulting in more inflation and higher interest rates, particularly since the Fed combats inflation by raising interest rates. Another effect is that this is a reason to buy a home now (assuming you can find the right house), locking in the interest rates we have today. If in fact rates rise, you’ll be happy you did, and if they moderate, then you can explore refinancing.

The big real estate story right now is the historic proposed settlement by the National Association of Realtors (NAR) and the four largest brokerage firms, as a result of a class-action lawsuit filed on behalf of Joshua Sitzer and Amy Winger, and copycat lawsuits that have followed. The lawsuit argued that NAR and the four biggest brokerage firms were setting (fixing) commissions for buyer agents at a high level, and apparently a jury agreed, resulting in huge settlements by NAR ($418M) and the four largest brokerage firms. The claim is that homeowners have been unfairly forced to pay artificially inflated buyer agent commissions when they sold their homes. This settlement money is to compensate the sellers of houses for the alleged extra cost incurred.

As primarily a listing agent, I’ve been asked by several sellers I met with over the past few weeks–wondering about this proposed settlement. Here are a few ideas, concepts and my thoughts on this:

I participated in a similar situation, where a class action suit against Facebook resulted in a $725M settlement. We were eligible, so I applied for our portion of that settlement, and received a check for a whopping $32, which was near the average payout. The lawyers, however, have billed $180M in legal fees, which apparently comes out of the little guy’s compensation. Of course there are probably a lot more people who have been on Facebook than have sold a house in the periods covered, but even so I’m absolutely positive that the big winners in this one will be the lawyers, yet again.

I’m also not always a fan of the jury system, although I don’t have a better idea off the top of my head. The problem with a jury is that to serve, you can’t know anything about the problem being adjudicated because that might prejudice your decision. That worked great in colonial times, when everyone was a farmer, but nowadays things are really complicated, and if you don’t happen to know anything about something, like real estate for instance, you’ve got a steep learning curve at best, and might not be the type of person to really understand complex transactional issues.

Sure, it does look bad at first glance, that the listing (selling) agent pays the buyer agent out of a commission charged against the final sale price of a property, and there’s a lot of money involved, but it’s hard to come up with a better solution, which is why everyone is so flummoxed. If you are selling a house, your goal is to get as much money in your pocket upon the sale of your house. Listing agents aren’t giving away 2% (2% locally, 2-½% closer to Boston) just to be nice. They are trying to get buyer agents to bring their clients to see the properties they are listing. Big crowds bring excitement, and increase the odds substantially that someone in that crowd will really like the house. If more than one person likes the house, a bidding war may result, typically increasing profits for the seller much more than 2%. This is particularly true because of our shortage of homes for sale.

The essential problem is that in a transaction like this, the only party that has the money to pay the buyer agent is the seller, when the house sells. Most buyers would be quite hesitant to directly pay a buyer agent 2% to help them look for a house, simply because they don’t have the money in their wallet, don’t have a house to buy, nor do they want to spend that much. For all they know, that very afternoon they could find the house of their dreams, and have to pay the agent 2% for four hours of work. They also need the money to buy the house. And from the agent’s point of view, although 2% sounds like a lot, remember that buyer agents make nothing until their client finds a house they like, and then has their offer accepted. Back to the beginning of this article–the housing market is extremely tight, so even if the buyers find a house they love, that certainly doesn’t mean they’ll get it. If they like it, maybe five or more other potential buyers like it too. Only the buyer agent whose client has their offer accepted, and can actually buy the house, makes the 2%. The other 20 or so agents make 0%, and it’s off to another open house and more showings. Unless you are a top buyer agent in your area, it’s a whole lot of work for not too much money. For the actual buyer, you need a good buyer agent, so you write an offer that will get you the house, plus helps protect you from buying a house that looks great but may have a lot of hidden issues.

So how are all the real estate agents, buyers, and sellers going to handle this major league curveball we’ve been thrown, and will it cause major disruption in the local real estate market? I’ll explain my thoughts on this with a personal analogy:

This Easter we were planning on the usual suspects coming to our Easter brunch–Jay and I, my brother Jay, four of our kids and one significant other. My mother Judy (who is an active participant in the meal prep, plus a great asset on dish duty) would not be joining us, because she would still be in Florida–the first time she’d be away on a major cooking holiday. Still, our plan made for a nice sized group that required cooking a meal for 8 people. This was three days prior to Easter.

However, and this is a true story–as of about 2 days before Easter, our party size grew to 24 people, which required a lot of scrambling–more food, two extra tables, a lot more chairs, silverware, dishes, even baby seats! Thrown into the mix was that Jay had a contact lens stuck in his eye and our Friday evening was spent in the ER until 10:00 PM. And you know what? It all worked out fine.

We adapted to the situation and everyone had a nice meal, we did a lot of socializing, and it turned out to be a memorable Easter, and with no crises. This is how I expect we’ll handle this new methodology for compensating buyer agents. No one is going to come up with a great idea, but rather we’ll all be doing what we have to do to help people buy and sell properties.

As of now we don’t exactly know how it will all work out, but we do know that we will adapt and it will work out. Just like preparing an Easter brunch when 36 hours before game time we learned that our crowd had grown to 24, with fully 50% of the guests never having been in our house before, and 10 people I had never even met until they showed up to the table. Adaptability, a depth of experience in the local real estate market, a strong moral compass, and a good attitude will go a long way.

If you’re considering buying or selling property now, over the summer, or further in the future, have a candid conversation with the listing agent or buyer agent you’re considering working with. If they’re worth their salt, they will be able to explain that buyer agent commissions have always been negotiable, how agents are paid, and your options going forward.

One final thought–Even considering all of this hullabaloo and with sellers thinking they’ll ‘save money’ by not paying buyer agents…if I were to list my own home for sale right now, this summer or in the future, I would absolutely offer compensation to buyer agents, even if not required. This isn’t just because I’m nice, not at all. It’s because if I were selling my property, I’d want to net the most money possible, and to make sure both parties (buyers and sellers) have professional guidance so that the transaction makes it all the way to closing.

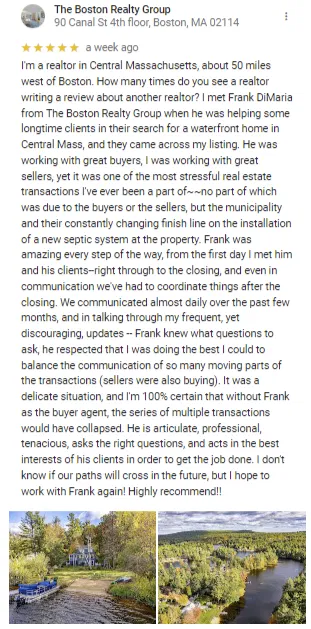

As primarily a listing agent working for sellers, I dread the idea of buyers thinking they’ll save money going directly to the listing agents–I wonder who will guide them on making decisions, ensuring they adhere to the dates in the contract, etc. etc. In fact, here’s a google review I recently wrote relative to a March 2024 transaction where I was the listing agent and there were two buyer agents involved (buyer agent for the buyers purchasing my listing, and my seller clients’ buyer agent where they were purchasing on Cape Cod–I haven’t had time to write the second review yet, but I will.)